Top Five 2023 Trends in Programmatic Advertising

Programmatic advertising has become an indispensable part of a publisher’s monetization techniques. Along with direct deals, events, subscriptions, native widgets, sponsored content, etc., you can usually see at least Google AdX ads on the page.

However, on more developed markets, you will now also see Prebid and Amazon header bidding partners. And in many cases a publishing organization can rely entirely on the revenue generated from programmatic ads on the site, skipping the investment into sales teams and the lengthy process of getting direct demand.

In the next quarters of 2023, we expect this trend to grow in a variety of areas, while the market matures, consolidates, and faces challenges.

1. Display Video Outbidding Traditional Display Demand

Relatively new players in the SSP market are being able to get a good Share of Voice within the publishers that have to open their ad stack for them. With video being shown within the display inventory they are able to win with higher CPMs and become even more valuable as compared to the traditional players in the market. They still however are not seen across all websites, as some publishers are reluctant on expanding their stack with heavy video ads.

“One thing we can see happening right now quite aggressively is the move of in-banner video into the normal display market. So in the past, if we were to look at where the top performing partners in a header bidding partner were, you would usually see something like Index Exchange, Xandr (formerly Appnexus), and Rubicon being the top partners. But over the last year or two, there has been a shift happening towards SSPs focused on bringing video into banner placements.

We have been able to capitalize on that quite well, generating a significantly higher impact on revenue. But of course, also on the downside in terms of network bandwidth, the total amount of requests happening over the ecosystem, and so on”, says Nils Lind Founder and CEO of Assertive Yield in the Programmatic Trends and Predictions 2023 video.

One uncertainty is what will happen as companies like Vidazoo, Minute Media, Adagio, etc, are becoming more and more popular.

Drawing attention to this might lead to a more suited pricing of video inventory, depending on whether it comes from a video player with relevant content on the page (pre-roll and mid-roll ads on publishers with video demand), a random video showing against the content (out-stream video players such as Primis, Vidazoo, Conatix) or a video shown inside a display ad unit.

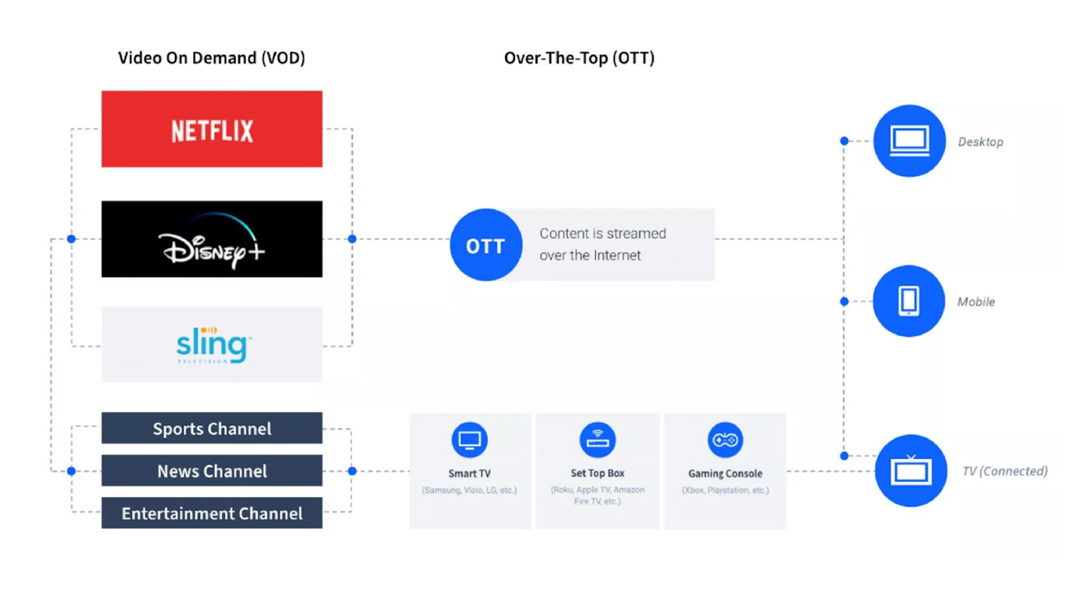

2. Growth of Connected TV, OTT, and Audio Advertising

Table Source: StackAdapt

Connected TV (CTV) and Over-The-Top (OTT) advertising are fast expanding as more consumers abandon traditional cable in favor of streaming options for television programming. Since marketers seek to target their audiences more efficiently across numerous screens, programmatic advertising is likely to play a significant role in this sector. Being a growing sector, it still confronts issues such as fraud and discrepancies.

Another subsection, that is rising recently is Prebid Audio ads, which might play a bigger role in the podcast industry, and who knows - in a revamp of the voice assistant devices, which are at a point where a lot of money has been poured in, with no actual return, and yet, with AI algorithms getting better and better they might become more and more useful.

3. Market Consolidation

In 2023 we’ve already seen EMX filing Chapter 11 for bankruptcy, and Yahoo announced they are planning to shut down its SSP business. For other companies, this decision may have another outcome - getting bought. It’s not something we haven't seen in the past several years, with examples like Magnite, SpotX, Freestar, and Sortable, but we might see it more often with SSPs buying out technological tools as well, to stay relevant in the market.

Since SSPs are getting further away from the demand aggregator function they have in the market, and becoming more media-faced solution packages, like Sovrn acquiring Proper and proposing demand, ad stack, and on top of that - affiliate integrations.

This development is also another way for companies in the sector to face threats of exclusion from the supply chain, as Tradedesk is currently doing with its Open Path.

4. Greener Traffic

The advertising association Ad Net Zero has put in place a plan aiming to reduce the carbon footprint of an industry where publishers are working with multiple SSPs, through several different header bidding platforms, occasionally repeating them, while SSPs tend to pass the auction requests to other SSPs and in the end, the same request reaches DSPs multiple times. This ballooned pursuit of demand and profitability results in a lot of wasted requests. Companies like Scope 3 are working on establishing where we are wasting the most energy. Here at Assertive Yield, we are focusing on helping SSPs reduce the wasteful queries going to DSPs without harming the profits.

We’ve already seen DSPs like The Trade Desk, Yahoo, and Amobee pulling out of Open Bidding - Google’s header bidding platform while continuing to work on Prebid and Amazon ones. And we are expecting SSPs to follow suit, especially the ones that operate heavily in all three spaces - with limited added value.

Publishers should pay close attention to these processes as they may end up losing demand due to a paradigm shift.

[Watch Now to the Podcast]

Read our full report on each programmatic player's challenges and the solutions in place for a greener future.

5. Cookies Finally Getting To The Point of Extinction

This has been a major topic in the industry for the past several years with iOS devices already blocking third-party cookies and Chrome browsers delaying the step further in time. But the biggest browser, a product of Alphabet, the company that also controls a big part of the ad-serving business, the biggest Ad Network, and the biggest buy platform, is now scheduled to finally move ahead with the cookie depreciation. What was expected to come in 2023 (after previous delays) has been delayed one more year to 2024. And although we can’t exclude the probability of getting one more delay on Google’s end, so far it seems like the shift is going to happen.

This means that in 2023 teams in the ad industry will be quite busy evaluating, testing, and implementing several of the technologies emerging to replace the beloved cookie. From the well-named CHIPS (Cookies Having Independent Partitioned State), through IAB’s Seller Defined Audiences, which got acclaimed by Google to both - email and non-email based userIDs in prebid, and the voice of returning back to contextual advertising.

In the next couple of years, some of these will fade away, some will earn good market shares, and who-knows - maybe new ones will arrive as well.

Besides the technological path to resolving this major challenge in the industry, we should also ask ourselves - what will happen as the advantage of Chrome is taken away?

Shall we expect a shift in the publishing space to optimize for more traffic from iOS, as this might end up valued the same as Android? Perhaps, we might see more Prebid S2S tests going around in 2023, as the biggest advantage of the client-side Prebid is set to go away.

AY Industry Insights Report: Google Cookie Depreciation and Topics API Impacts

Unveiling the future: Equip your team with a comprehensive report on the cookieless user landscape - delve into revealing scenario data, assess initial impacts, and explore alternatives with an exclusive checklist tailored for publishers.

Download

AY Product Updates in H1’24 AY Prebid Server, Yield Manager New Version, INP, Cookie Deprecation Updates, and more!

Read more

Q1'24 AY Industry Insights Report - Publisher Trends, Global Programmatic & Ad Revenue

Read more

Breaking Free from AMP in 2024: Top 7 Challenges and Groundbreaking Solutions for Publishers

Read more